Taking a company public isn’t just a milestone—it’s a transformative journey that opens up a world of opportunities. But let’s be real: the IPO process is complex, fraught with regulatory hurdles, financial intricacies, and strategic decisions that can make your head spin. That’s where CAPSNA steps in, turning what could be an overwhelming ordeal into a streamlined, strategic endeavor.

Why CAPSNA’s Experience Matters

With years of cross-industry experience, CAPSNA understands the nuances of various markets, ensuring tailored IPO strategy and compliance solutions. Our experts guide you through every stage, from pre-IPO planning to post-IPO compliance, making your public debut a seamless success.

Before anything else, it’s crucial to know if your business is IPO-ready. CAPSNA brings a wealth of experience in assessing a company’s readiness to enter the public markets. The team of experts dive deep into your financials, corporate structure, and compliance status to ensure you meet all the regulatory requirements. It’s like having a seasoned navigator charting the course before the ship sets sail.

Getting the valuation right is an art and a science. Overestimate, and you risk scaring off potential investors; underestimate, and you leave money on the table. CAPSNA leverages industry benchmarks, financial projections, and market trends to pinpoint a valuation that reflects your company’s true worth. CAPSNA helps you tell your story in a way that resonates with investors, highlighting your strengths and growth potential.

Deciding on the IPO price and the size of the issue is a balancing act. CAPSNA guides you through this by analyzing market appetite, investor sentiment, and your capital needs. The team of experts help structure the offering to optimize funding while maintaining investor interest, ensuring that the shares are priced attractively without diluting existing ownership more than necessary.

Capital raised from an IPO can be the fuel that accelerates your company’s growth. CAPSNA advises on how best to allocate these funds—whether it’s capacity expansion, R&D, entering new markets, or bolstering working capital. CAPSNA helps align the utilization of proceeds with your strategic objectives, maximizing the impact of every dollar raised.

An IPO isn’t a solo endeavor; it’s more like orchestrating a symphony with multiple critical players:

- Merchant Bankers: CAPSNA helps you select bankers who not only understand your industry but also have the right investor networks.

- Market Makers: They facilitate liquidity in your stock post-listing. CAPSNA ensures you’re partnered with market makers who can maintain healthy trading volumes.

- Registrar and Transfer Agents (RTA): CAPSNA coordinates with RTAs to manage share transactions efficiently.

- Dematerialization of Shares: Transitioning to electronic shares is standard in modern markets. CAPSNA oversees this process, making your shares easily tradable and accessible to investors.

Dealing with stock exchanges and regulatory bodies requires expertise and finesse. CAPSNA acts as your ambassador, handling submissions, responding to queries, and ensuring compliance with listing requirements. The team of experts speak the language of regulators, which can significantly smooth out the approval process.

The journey doesn’t end once the shares start trading. There are ongoing compliance obligations, from financial reporting to corporate governance standards. CAPSNA provides guidance on:

- Pre-IPO: Ensuring all prospectuses, disclosures, and legal documents are in order.

- Post-IPO: Advising on periodic filings, shareholder communications, and adherence to regulatory changes.

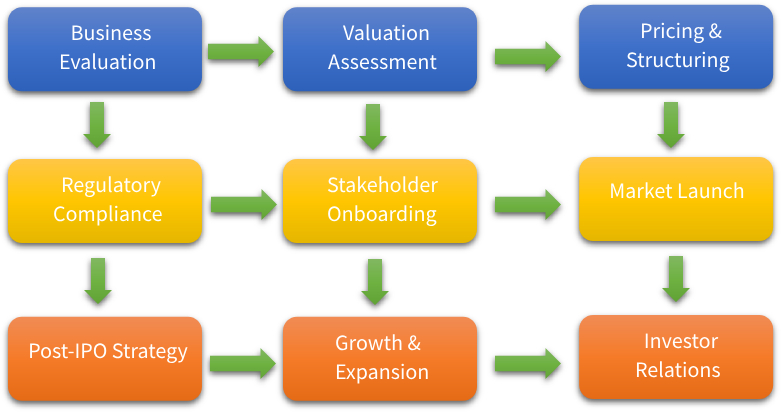

Visualizing the IPO Journey

Each step is interconnected, and CAPSNA ensures that transitions between stages are seamless.

The Bigger Picture

Going public is more than just accessing capital—it’s about enhancing credibility, attracting top talent, and increasing brand visibility. It’s a bold statement of intent in the marketplace. With CAPSNA by your side, you’re not just preparing for a financial transaction; you’re strategizing for a new phase of exponential growth.

Looking Ahead

Embarking on an IPO raises big questions about the future of your company:

-

-

- How will public ownership change your corporate culture?

- What are your plans for leveraging the increased capital?

- How will you manage shareholder expectations and market pressures?

-

CAPSNA doesn’t just prepare you for the IPO day—the expert team helps you strategize for life as a public entity.

If you’re contemplating this leap, it’s worth engaging deeply with advisors who see the full spectrum of challenges and opportunities ahead. What aspects of the IPO process intrigue or concern you the most? Exploring these thoughts could be the first step toward a successful public debut. Get in touch…

Ready to Take the Leap? Schedule a FREE IPO Consultation!

Going public is a game-changing decision. Partner with CAPSNA to ensure a seamless IPO process, regulatory compliance, and long-term market success.

Contact us today to discuss your IPO strategy and take the first step toward becoming a publicly traded company!